All Blog Entries by Gary Zimmel (Admin)

Mortgage Update From Danielle Franke, Mortgage Broker

So… Christmas Parties have already gotten the best of me and I missed sending this out on Friday.

As you know Prime went up by 0.50% last week.

Here is the info we sent to clients who are currently in a variable rate mortgage.

The Bank of Canada raised their key interest rate by .50%.

The Bank of Canada has raised their key interest rate by 0.50%, now at 4.25%. This is the first time the Banks rate has hit or surpassed 4% since 2008. This is the 7th consecutive rate jump, and although this move was anticipated, it was uncertain if it would increase by a quarter or half point. With inflation dropping to 6.9% in October, and core inflation still being around 5%, the move to an oversize half a point suggests that this increase is perhaps an

…December 12 Rate Monitor

December 2, 2022 Rate Monitor

Oh December… How I love thee!Such an exciting energy in the air, and surprisingly my phone has been ringing with pre-approvals, so this is a good sign for 2023. I believe the slow down due to rates are not as effective, as people get used to change and still need a place to live. Also rent is increasing so why not buy!! With qualifying rates over 7%, the max purchase prices have lowered, so remember the purchase plus improvement program is a good way for clients to get the home they can afford but still get the kitchen of their dreams!! No real news this week, hope you have an amazing weekend! Best Regards,

Danielle Franke Mortgage Broker Owner

Rates on the Rise Again- Update for October 21st.

I hope you had a great week! I was at a Mortgage Conference earlier this week and we had Benjamin Tal- Chief Economist of CIBC as one of the guest speakers. He said something very interesting which stayed with me. He stated that the “Bank of Canada would rather be in a Recession than an Inflation. And that they will do all they can to get out of inflation.” Inflation is affected by many things, but the interest rates is what the Bank of Canada can control so they are increasing rates and will most likely keep them elevated for a while to get out of inflation. This means that we will continue to see rates increase this year and then most likely hold for 2023 and then will start coming down in 2024. This week with the announcement that inflation rates

…Mortgage Rates as of October 14th

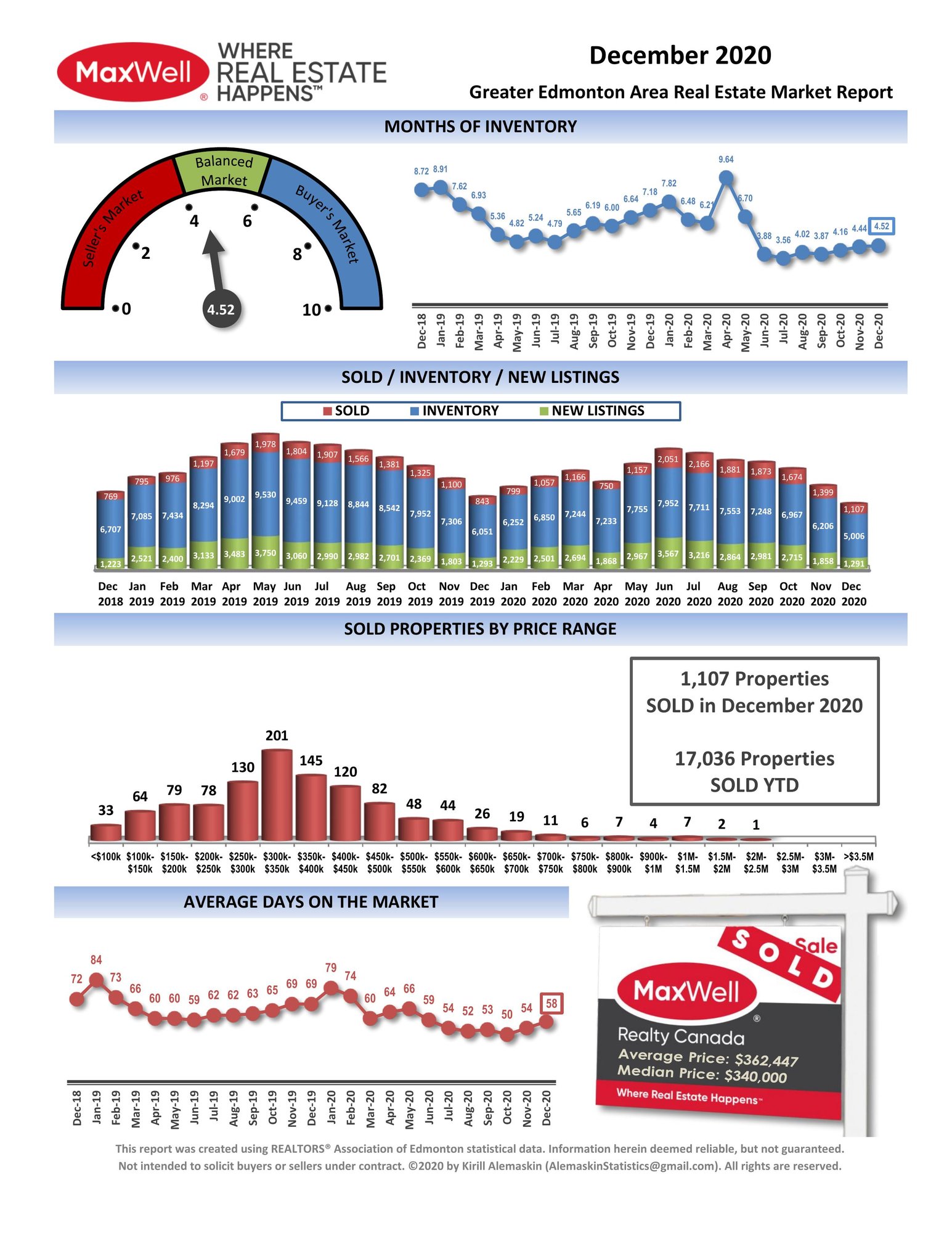

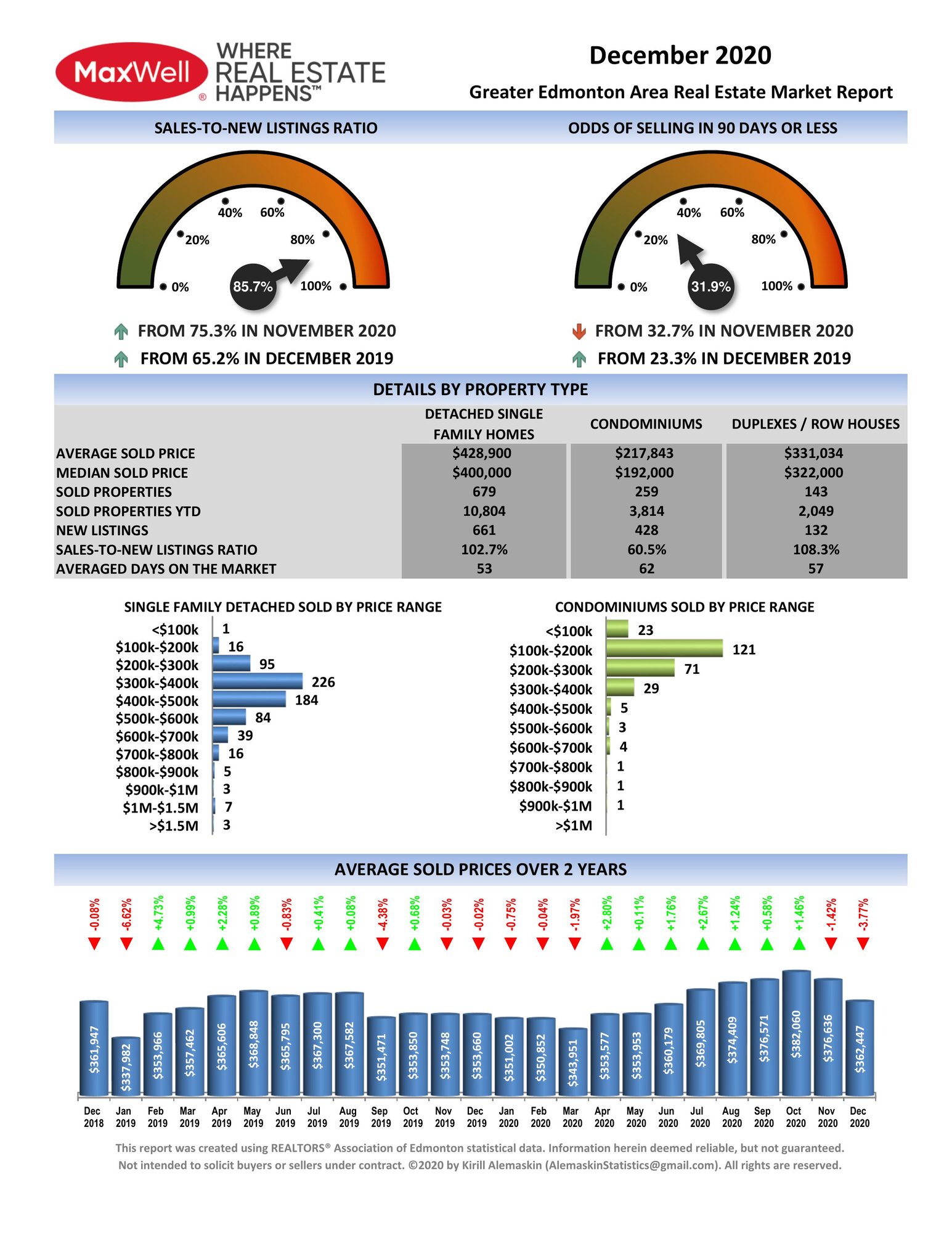

Edmonton and Area December Market Stats.

What Determines Mortgage Rates.

Motgage Rate Update Nov. 2020

Mortgage Rate Update Oct. 30